Great Lakes Iron Ore Shipments Slip in July; Year-to-Date Totals Lag

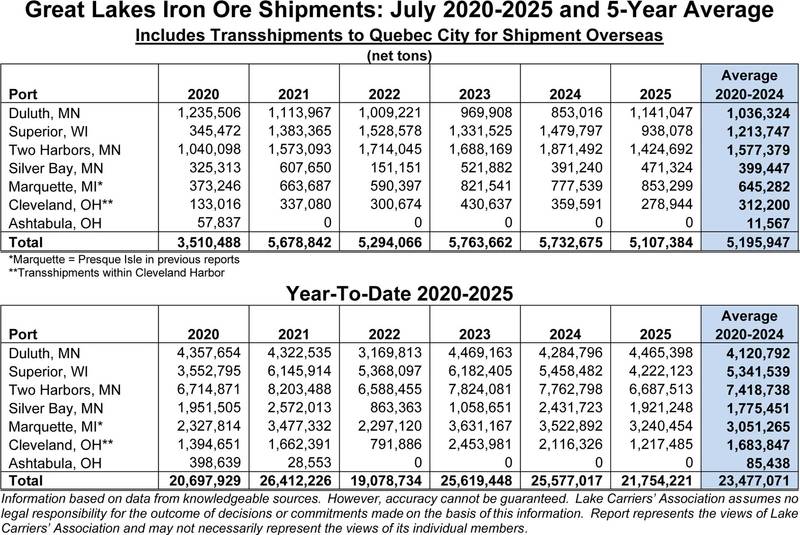

The Great Lakes iron ore trade lost momentum in July, with shipments totaling 5.1 million tons — a 10.9% decline compared to the same month in 2024, according to the Lake Carriers’ Association (LCA). The July volume also came in 1.7% below the five-year average, signaling that weaker conditions are not just a one-month anomaly.

The year-to-date picture is similarly soft. Through the first seven months of 2025, the Lakes fleet has moved 21.8 million tons of iron ore, down 14.9% from a year earlier and 7.3% below the five-year average. The slowdown comes despite the U.S.-flag fleet’s ability to move more than 90 million tons of dry bulk cargo annually, serving the steel, energy, and construction sectors.

Port-by-Port Performance

Port activity showed a mixed pattern in July. Duluth, MN, led all loading points with 1.14 million tons, rebounding from last year’s 853,000-ton total. Two Harbors, MN, followed with 1.42 million tons, down from 1.87 million in July 2024. Superior, WI, saw one of the steepest year-on-year declines, falling from nearly 1.48 million tons last July to just 938,000 this year.

On the Michigan side, Marquette handled 853,000 tons, up from 778,000 in July 2024, while Silver Bay, MN, moved 471,000 tons versus 391,000 last year. Cleveland, OH — which includes transshipments within the harbor — saw volumes dip to 279,000 tons from 360,000 in 2024.

Year-to-Date Leaders

From January through July, Two Harbors remains the workhorse port with 6.69 million tons shipped, although that’s down from 7.76 million a year ago. Superior’s year-to-date volume of 4.22 million tons is off sharply from more than 5.45 million in 2024, while Duluth posted a modest gain to 4.47 million tons. Marquette’s cumulative 3.24 million tons trails last year’s 3.52 million, and Cleveland’s 1.22 million tons marks a significant drop from 2.12 million.

Industry analysts point to a combination of lower steel production, fluctuating export demand, and vessel scheduling factors as contributing to the softer numbers. With the fall shipping season approaching — traditionally a high-volume period for iron ore — carriers will be watching closely to see if demand from steelmakers and overseas buyers can lift the trade back toward historical averages.