Inland Waterways System: Driver for the U.S. Economy

“In a global marketplace, supply and demand in one area of the world can greatly impact the agricultural production in another. American products are shipped worldwide …” is how the U.S. Department of Agriculture (USDA) describes the backdrop for international trade. The inland and coastwise waterway systems serving the United States (where agricultural cargoes are an important component) are sometimes regarded as insular highly specialized marketplaces. However, they are indeed elements of much larger trading networks that are influenced by global economic, geopolitical and-in recent years, climate-related forces. Thus, headline events all over the world, which might be tariff-related stops and starts of trade, shifts in cargo flows due to hostilities, and surpluses and shortfalls tied to droughts and other weather events, will all affect flows of cargo through U.S. waterways.

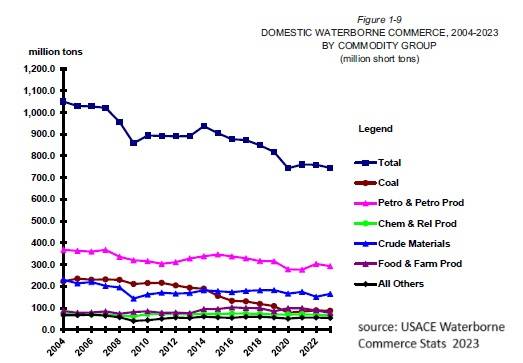

The latest available data from the U.S. Army Corps of Engineers (USACE) shows that the “internal portion” of U.S. waterborne commerce decreased from 622 million st in 2007, to 449 million st during 2023.

Looking more closely at barge traffic, major flows included petroleum and products (135.5 million st), chemicals (48 million st) and food and farm products (73.3 million st). But looking at the internal tonnage flows (with cargo origins and destinations all on the river system) does not provide a full picture. In spite of the reduced demand side over time, the supply side of the equation (ie. the barge fleet) currently more than 22,000 units overall, and has risen only moderately in that time frame. Average length of haul for “internal” moves has actually increased during 2007 – 2023, from 437 miles to 494 miles, according to USACE data.

On the river systems, the USACE data shows that the Mississippi dominates, but highlights the relationship between “internal” barge flows with major “export” and “import” components, on deep sea vessels; the vicissitudes in foreign trade are among the drivers of the barge flows. While the “internal” component of Mississippi River flows was 264 million st in 2023 (included in the 449 million st mentioned above), this was nearly equaled by the 194.2 million st of flows tied to “foreign” (imports and exports) trade noted by the USACE, where a barge move is linked to a deepsea move.

Inland market participants are closely watching the international trade developments, including the loud rhetoric on tariffs, which caused China to put levies on cargo originating in the U.S., ultimately impacting on-river moves.

The trade association BIMCO, representing participants in deep sea shipping, said: “During the first half of 2025, U.S. seaborne grain shipments increased 9% y/y, driven by stronger maize exports. While an increase in import tariffs led to a 57% y/y drop in volumes to China, the U.S. has been able to find alternative markets for most of its cargoes.”

Thus, spot market barging freight rates in Spring 2025 were consistent with seasonal levels from recent years.

But nevertheless, observers are closely watching Trump 2.0 administration’s policies on tariffs, looking for impacts on grain exports as retaliatory actions by overseas customers for U.S. agricultural products might impact export tonnages negatively (BIMCO views notwithstanding). In 2023, 153.5 million st of “food and farm products” were tied to export moves. The steel and metals sectors, moving import cargo on the rivers (nearly 50 million st in 2023), may also see trade policy-related impacts.

Coal transport, in barges moving down the Ohio and Mississippi River systems, can be seen from the “export” figures for coal, pegged at 38.2 million st in 2023. In recent years, it has varied widely from 48.1 million st in 2018 to 18.6 million st in 2020, with pandemic related factors reducing demand.

In contrast to “export” related moves, reduced coal moves on the rivers figure prominently in recent “domestic” declines; USACE charts show coal moves on the Ohio River of 133.1 million st in 2014 cut by more than half to 61.5 million st in 2023. It is not clear whether and how recent Trump 2.0 easing of restrictions on coal fired power plants will impact demand for coal barging on the rivers.

“The ongoing reshuffling of domestic operator portfolios by private equity firms may release some asset availability, but the quality and age of those vessels often limits their appeal. Looking ahead, we expect a selective market through the remainder of 2025, with transaction volumes tied closely to geopolitical stability, evolving environmental mandates, and operators' ability to balance long-term investment with near-term financial realities.” Marcon International, a leading broker in the sale/ purchase of maritime equipment

Image courtesy: Zoilo Marrero

You Can’t Beat Mother Nature

Seasonality and climate matters play a major role in the economics of barge transport, particularly in the realm of transporting grains and agricultural products, with an important spot market component. Ken Eriksen, Managing Member and Strategic Advisor at Polaris Analytics and Consulting, an expert on the inland marketplace, explained to Marine News that: “Climate issues are increasingly on the minds of industry participants. Indeed, low water levels, very notable over the past three years, have been a recurring problem. Commerce still moves, as all the stakeholders have worked out ways to blunt the impacts from that low water situations. Likewise, the high-water events often seen during the Spring season can be managed as the vessel operators, the cargo side, the terminals, and the regulators all cooperate closely on managing these types of issues.”

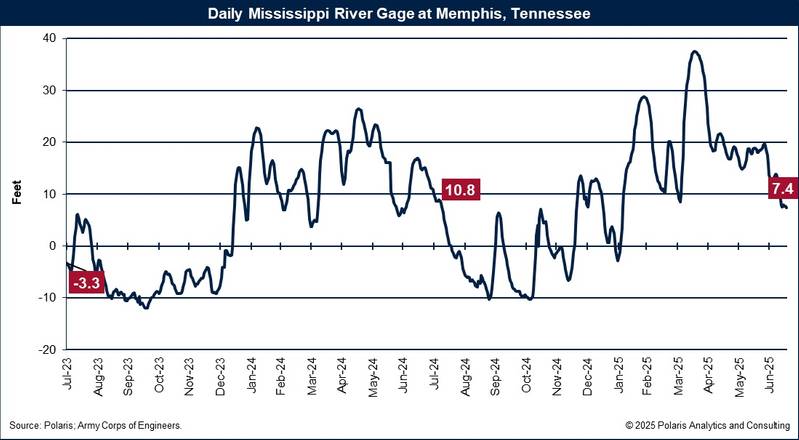

River gauge data, reflecting the water levels on the Mississippi River at Memphis, shows dramatic seasonal swings.

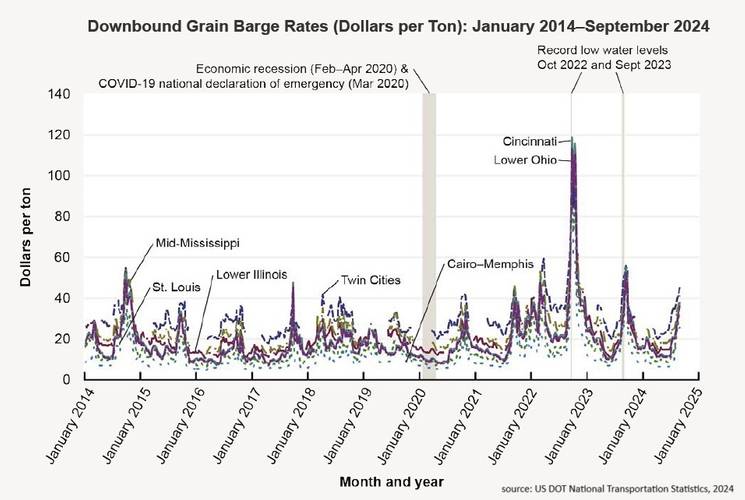

In turn, the variability in water levels has an impact on freight pricing. While much barge traffic moves under contractual arrangements, the portion moving under “spot” bookings (notably on the grain side but also in the weather-sensitive coal trades) is subject to dramatic ups and downs. Data from the U.S. Department of Agriculture provides insight into some of the volatility in the spot segments of the marketplace, with grain moving in covered hopper barges. Typically, the demand side rules in 3Q and into Q4, the times of peak harvest, but the upward bumps are not always uniform. October 2021, saw an extreme, albeit quick to correct, move, with a composite of downbound rates jumping to 2100 (a percentage of “tariff”- equating to around $120/ton), versus recent values in the upper 400’s (equating to around $30/ton - $40/ton).

“Variability” also characterizes the motives for buying and selling of vessel fleets. A recent report from Marcon International, a leading broker in the sale/ purchase of maritime equipment, including in the domestic trades, noted that: “The ongoing reshuffling of domestic operator portfolios by private equity firms may release some asset availability, but the quality and age of those vessels often limits their appeal. Looking ahead, we expect a selective market through the remainder of 2025, with transaction volumes tied closely to geopolitical stability, evolving environmental mandates, and operators' ability to balance long-term investment with near-term financial realities.”

As the Marcon comments allude to, investors have the inland sector in their sites. Financier James Lightbourn, from Cavalier Shipping, provided an overview of barging’s attractiveness, telling Marine News: "While the inland barge industry is opaque, it has a lot of features that make it an attractive for U.S.-based investment funds. Tugs and barges are real-world physical assets that can be pledged as collateral which makes them appealing to equipment finance providers, they often have long-term contracts associated with them which entices infrastructure funds.” BY THE NUMBERS: Domestic waterborne commerce

BY THE NUMBERS: Domestic waterborne commerce

Graphic courtesy U.S. Army Corps of Engineers

BY THE NUMBERS: River Gaging

BY THE NUMBERS: River Gaging

Image courtesy Polaris Analytics & Consulting

Private & Public: Ownership Profiles

Many of the participants in the business are privately owned (some exceptions being Kirby Corporation, on the liquid side, and American River Transportation Company (ARTCo) a subsidiary within listed grain giant ADM), with financing traditionally provided by regional banks. Quite often, these institutions will also have asset-based lending divisions. The long-term nature of many barging contracts (and with financing provided through leasing and bareboat charter structures) has also allowed financial investors to join the fray; they can buy the companies, restructure existing debt, and then sell investment units to pension funds and family offices who might also be looking at “infrastructure investments” (offering steady distributions over multi-year time periods).

2025 saw Maritime Partners, a Metarie, La.-based specialist in this area, acquire Centerline Logistics, operating coastwise and in harbors; in 2021- 2022, its managed funds had acquired the 1000+ vessel fleet of J. Russell Flowers. This acquirer has deployed debt from Credit Suisse and Stonebriar Financial in funding its growth.

Long term investors needing reliable and steady payouts are attracted to the inland barging business. Consider the Kentucky Retirement System (KRS), serving pension and insurance recipients in the Bluegrass State, with multiple riverports and numerous terminals along the Ohio River system. In 2023, the pension manager made a substantial investment in the open-ended American Rivers Fund LLC (tied to Maritime Partners). Returns, in the form of periodic distributions, met targets in place. At the end of March 2025, the County Employees Retirement System (CERS, a pension manager within KRS) had “total pension fund commitments” of $175 million with Maritime Partners. In May, 2025 its Board voted to authorize additional investments of up to $70 million with Maritime Partners.

Private investment entities also seek steady returns over time, which are nicely supported by the contractual nature of the barging business. Redwood Holdings, a Washington, DC based “family office”, had recently acquired liquid specialist Canal Barge, following on its 2024 acquisition of Marquette Transportation in 2024 (which had previously been in the hands of other financial investors).

Fixed assets like barges and boats also provide opportunities for savvy packagers to generate “tax efficient” streams of income, through deductions for depreciation. In 2024, SCF Leasing was sold by its parent, Seacor Holdings (once public, but since 2021 in the hands of private equity packager American Industrial Partners) to an infrastructure division within Ingram Barge, the leading operator in the dry barge sector (with nearly 3,900 barges). Other large operators in the dry sector include ACBL, with more than 3,000 barges and ARTCo, part of agri-giant ADM, operating in excess of 1,800 barges.

In this time of extensive war-related disruptions to deepsea shipping, the inland side presents a happy contrast, with financier Lightbourn saying: “…the entire industry is contained within the U.S. which mitigates some of the impact of tariffs and today's other geopolitical uncertainties."

In announcing the recent Marine Highway additions, Sean Duffy, Secretary of the U.S. Department of Transportation (USDOT, which oversees MARAD) summed up the role of the inland system, stating that: “Maritime dominance isn’t just about our oceans. Our nation’s many rivers and inland ports are crucial resources to moving great American products to markets across the country and around the world.” ACBL boat at lock on upper Mississippi.

ACBL boat at lock on upper Mississippi.

Image courtesy: U.S. Army Corps of Engineers

Politics, Lobbyists and the U.S. Inland Waterway System

The industry is well represented in Washington, D.C. In particular, the American Waterways Operators and the Waterways Council Inc. support the industry in reaching out to legislative and committee staffers on Capitol Hill. Other groups, representing the cargo shippers, also keep inland waterway issues in front of Congress.

AWO plays a vital role in looking after smooth operations along the rivers and coastal harbors where members’ vessels operate. In an early May letter to the Office of Management and Budget (OMB), responding to a Trump administration request for regulatory streamlining, AWO said: “AWO is also gratified by President Trump’s recognition of the importance of a flourishing domestic maritime industry to national security and economic prosperity, as demonstrated in his recent Executive Order, Restoring America’s Maritime Dominance.” Referring to a list of suggested reforms, an AWO newsletter said “The list, which was informed by conversations with members and the Executive Committee, is inclusive of regulations recommended for recission because their costs exceed their benefits, they are outdated or unnecessary, or they impose unreasonable burdens on towing vessel and barge operators.” The suggestions for reforms touched on subjects including vessel inspections, casualty investigations, navigation safety, and maritime security matters.

The Waterways Council Inc. is heavily focused the waterway infrastructure. It is girding for the U.S. Congress’s action, in 2026, on the Water Resources Development Act (WRDA), which supports the work by the USACE on construction and rehabilitation of locks, dams and other parts of the waterways’ physical framework. The group described the 2024 WRDA, signed into law in January, 2025, as “A Big Win”, with funding for maintenance but also for new USACE projects. The American Society of Civil Engineers (ASCE) in its “Infrastructure Report Card”, described the bill (on the books as PL 118–272, which authorized funding for multiple USACE inland waterway projects (and numerous feasibility studies on additional works, as “…a rare example of bipartisan cooperation in an era of deep polarization.”

The National Grain and Feed Association, representing grain shippers, offered that WRDA 2024 “… includes smart adjustments to the cost-share provisions for construction and major rehabilitation of inland waterway infrastructure.”

The U.S. Maritime Administration (MARAD) also plays a role in the inland systems. In July, 2025, the United States Marine Highway Program (USMHP, overseen by MARAD) announced an addition of 848 miles of navigable inland waterways to its network- serving Kentucky, Tennessee, West Virginia, Arkansas, and Louisiana. Projects along the Big Sandy River, Cumberland River, Green River, and Ouachita River are now eligible for possible funding, through grants for terminals, new equipment, and support of barge services, under the USMHP.