Grain Shipments Halved from Russia, Ukraine

“Russian and Ukrainian grain shipments are estimated to have plunged 49% combined y/y between January and August 2025. Both countries had a smaller export surplus following weaker grain harvests in the second half of 2024. Overall, the combined production from both countries was 10% below pre-war levels,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.According to data from the U.S. Department of Agriculture (USDA), Russian and Ukrainian grain harvests fell by 12% and 6% respectively last year due to poor weather conditions.

Ships Queue at Russian Grain Port

Russian grain exports via the Black Sea port Kavkaz, which accounted for almost a quarter of all seaborne exports last season, have been significantly hampered this month due to new ship entry and inspection requirements, industry sources said.Foreign vessels require permission from port authorities and approval of Russia's FSB security service to enter the country's ports, according to a decree in July by President Vladimir Putin.Since the beginning of August, around 350,000 metric tons of grain have been shipped through Kavkaz…

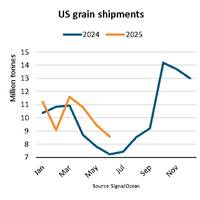

US Grain Shipments Surge 9% in face of Chinese Tariffs

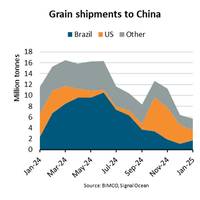

“During the first half of 2025, US seaborne grain shipments increased 9% y/y, driven by stronger maize exports. While an increase in import tariffs led to a 57% y/y drop in volumes to China, the US has been able to find alternative markets for most of its cargoes,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.In March 2025, China introduced higher tariffs on US grain shipments, significantly reducing the competitiveness of US cargoes. As a result, the share of US grain cargoes destined for China plunged from 26% in the first half of 2024 to just 10% in 2025.

Russia Grain Exports Plummet 63%

Russia's seaborne grain exports fell to 2.1 million metric tons in May, a fall of 62.9% compared to the same month of 2024, according to shipping data from industry sources released on Monday.Russia, the world's leading wheat exporter, shipped grain to global markets at a record pace during the first part of the 2024/25 marketing season, which began on July 1 last year. However, the introduction of export quotas in February resulted in a sharp decline in exports.Total seaborne exports have reached 44.6 million tons so far this season…

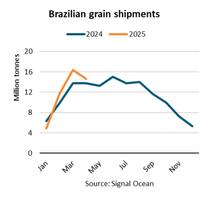

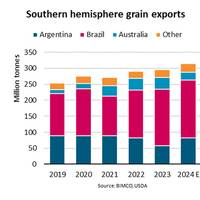

BIMCO: Brazilian Grain Shipments Up 9% as China Seeks US Alternative

Between January and April 2025, Brazilian grain shipments rose 9% y/y, supported by strong Chinese purchasing, according to Filipe Gouveia, Shipping Analysis Manager at BIMCO.The ramp-up in exports has been supported by a 9% increase in the soya bean harvest, according to estimates by the United States Department of Agriculture (USDA). Shipments were weakest in January due to a delay in the harvest, but they quickly ramped up in February, driving an increase in ship congestion.

Only One Bid, DEME, for Argentina River Dredge Contract

Belgian company DEME Group was the sole firm to bid in the Argentine government's tender for a major maintenance contract for the Parana waterway, a key route for grains transport, the government said on Wednesday.The bid could mark a major shakeup in dredging the river, part of a route from inland areas of Paraguay, Bolivia and southern Brazil out to sea. Argentina ships out some 80% of its massive farm exports along the waterway.Belgian rival Jan de Nul currently holds the concession to maintain the river and has for decades…

China Grain Imports Plummet 51%

“In January, grain shipments to China are estimated to fall 51% y/y, partly due to a decline in import demand for soya beans caused by low crusher margins. Although Chinese soya bean production decreased 1% y/y in 2024, inventories are high after a surge in imports in the first half of the year. Import demand for maize and wheat has also declined due to record high harvests in China in 2024,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.As the world’s largest grain importer, China has for a long time strived to reduce its import dependence.

Argentina’s Grain Exports Could Jump 40%

“Argentina is on track to boost grain exports by 40% in 2024, recovering from last year’s drought which afflicted crops, but still below the 2019-2022 average. Climate patterns and government policy are shaping the outlook,” says Filipe Gouveia, Shipping Analyst at BIMCO.El Niño has brought improved weather conditions for Argentina’s grain crops. The wheat harvest is nearly complete and estimated to be 20% larger than a year ago. Meanwhile, the favorable conditions continue to support the growing maize and soybean crops.

Congestion Plagues Brazilian Ports

Brazil is the world’s largest grain exporter, accounting for 24% of the world’s exports in 2022, and congestion has surged this year due to large harvests and low water levels in the Amazon River.“Congestion for ships loading grain cargoes at Brazilian ports has surged this year due to large harvests and low water levels in the Amazon River. Between January and November, the average waiting time reached 15 days, up from nine days average between 2018 and 2022 and well above the global average of five days for grain loadings in 2023…

Panama Canal Woes to Delay Grain Ships well into '24

Bulk grain shippers hauling crops from the U.S. Gulf Coast export hub to Asia are sailing longer routes and paying higher freight costs to avoid vessel congestion and record-high transit fees in the drought-hit Panama Canal, traders and analysts said.The shipping snarl through one of the world's main maritime trade routes comes at the peak season for U.S. crop exports, and the higher costs are threatening to dent demand for U.S. corn and soy suppliers that have already ceded market share to Brazil in recent years.