Oil Shock for Ship Recyclers

This has been a disastrous week for nearly all the key indicators tracked by cash buyer GMS, says the company, including the state of oil futures, freight rates, local steel plate prices, and disastrous currency devaluations (especially in India).

“To start, oil found itself slipping rather shockingly as it fell to USD 57.68/barrel – a total drop of over 6% in the last month and over 16% lower than the same time last year," says GMS.

“At the same time, governments in the U.S. continue their sanctions and blacklist wave as EU members too are reportedly preparing the 20th batch of sanctions against Russia that could authorize member-state navies and coast guards to board shadow-fleet vessels suspected of carrying sanctioned cargoes.

“The proposal also considers granting third-country flag administrations permission to deregister such vessels and further tighten flag-state cooperation to curb evasive shipping activities. Moreover, the U.S. continues to tighten Iran’s economic activities and levy further sanctions that have now wrapped a reported 170 ships in the tangle of global blacklists.”

All of this has trickled down to the ship-recycling industry, says GMS, as not only is supply getting increasingly restricted, but steel plate prices also fell in both Bangladesh and Pakistan, all while Bangladeshi and (especially) Indian currencies staged a late-Thanksgiving horror show this week.

“There was some encouraging news with the first Pakistani ship-recycling yard set to receive Hong Kong Convention approval reportedly as early as next week, with another 2–3 set to follow in the next three months, while others are expected by the mid-way point of next year. Bangladesh also reported further yards being certified as the number gradually approaches 20.”

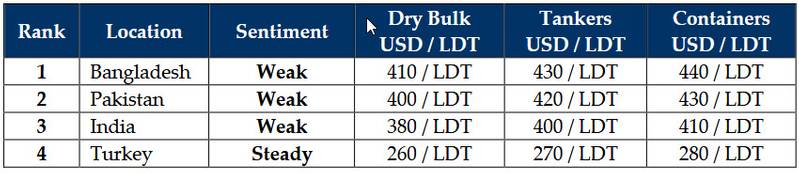

GMS demo rankings / pricing for week 47 of 2025 are: