Replacement vs. Retrofit: What’s Trending in the Dredging Market

In a year marked by uncertainty, the dredging industry remains resilient, adapting to evolving challenges with steady progress.

As we look toward 2026, the outlook for dredging services and equipment remains strong, with the market projected to rise from $8.9 billion to $9.3 billion—a 4.5% year-over-year improvement.

Yet, as demand grows and expectations shift, industry operators must ask a more nuanced question: should they invest in brand-new equipment or retrofit existing assets?

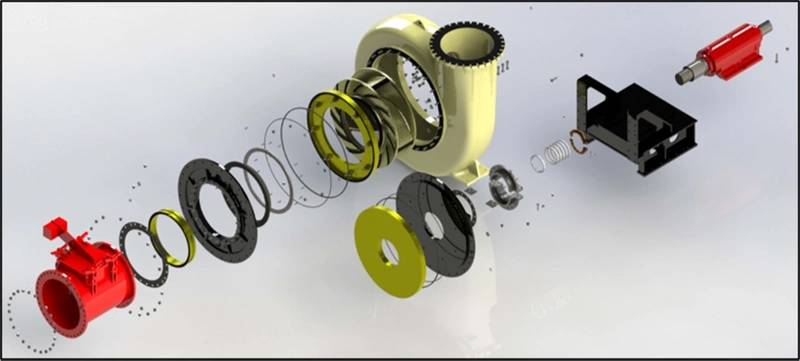

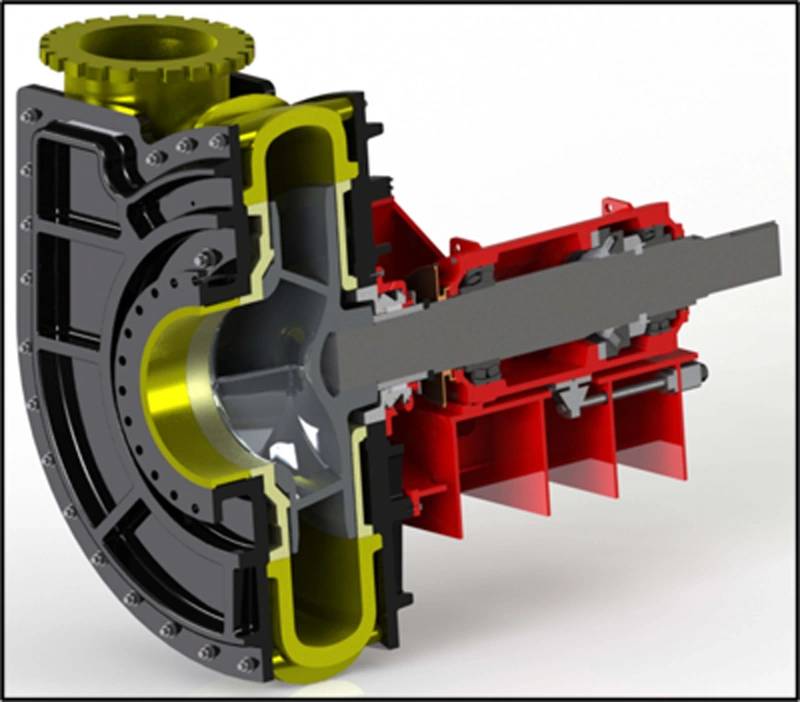

This decision is rarely straightforward; rather, it’s shaped by a multitude of practical considerations. Market forecasts remain robust, and as the industry expands, the rationale behind choosing replacement or retrofit becomes increasingly strategic.  Image courtesy Mobile PulleyReplacement

Image courtesy Mobile PulleyReplacement

Opting for new equipment brings its own compelling advantages, particularly when existing assets have reached the limits of their technological relevance or structural integrity. In scenarios where vessels or machinery have sustained significant wear, corrosion, or fatigue, the cost and complexity of comprehensive repairs may outweigh the benefits of restoration.

New builds incorporate the latest advances in engineering, automation, and eco-friendly design, offering operators heightened reliability, improved efficiency, and reduced emissions from the outset. These innovations can be critical where stringent regulations or ambitious sustainability targets challenge older fleets, which may struggle to keep pace with evolving standards. Moreover, replacement enables the integration of fully optimized systems, resulting in seamless operation and increased productivity.

For companies seeking to scale operations or enter new markets, investing in state-of-the-art equipment can serve as a catalyst for growth, enabling the adoption of capabilities that legacy assets simply cannot support. While initial expenditures for replacement are higher, the long-term savings in maintenance, downtime, and regulatory compliance often justify the investment, especially for assets nearing the end of their useful life. By choosing to replace rather than retrofit, operators ensure their fleet is future-ready—prepared to meet both immediate and long-term industry demands with confidence and agility. Image courtesy Mobile Pulley

Image courtesy Mobile Pulley

Retrofit

In contrast, when a vessel’s structural integrity is sound, but its internal systems or components are outdated, targeted retrofits offer a strategic path for revitalization. This strategy is particularly attractive in regions where sustainability standards and emissions regulations are becoming increasingly stringent, making retrofitting a cost-effective way to modernize without the price tag of new builds.

Retrofitting enables operators to upgrade critical technologies and equipment without incurring capital costs and lead times associated with acquiring new builds. This approach can extend the useful life of valuable assets while also improving performance, safety, and compliance with evolving environmental standards. It is especially advantageous for projects requiring specified capabilities, where custom upgrades can be tailored to meet unique operational demands or regulatory requirements.

Retrofitting also allows companies to modernize their fleet incrementally, spreading investments out over time and maximizing their return on existing capital, while simultaneously supporting sustainability goals by minimizing waste and resource consumption. In volatile market conditions, this flexibility can be the key to maintaining competitiveness and operational continuity.

Looking Forward

The global dredging market is poised for continued growth, but how contractors respond to changing conditions will define the competitive landscape ahead. For many, the choice between retrofitting and outright replacement is not a simple either-or decision; it requires a holistic evaluation of operational goals, regulatory demands, environmental responsibilities, and financial realities.

Full replacement offers peak efficiency for aging fleets, yet retrofits allow companies to maximize value from their current assets by introducing targeted upgrades for upcoming projects.

Increasingly, industry leaders are blending approaches—selectively upgrading some equipment while replacing others—striking a balance that ensures both operational flexibility and optimal returns on investment.

For suppliers, this evolving market means that while consumable and replacement parts remain in demand, there are also expanding opportunities for advanced machinery and innovative components. Ultimately, the future of dredging will not hinge on choosing between replacement or retrofit, but on finding the optimal mix to meet both present needs and future ambitions.