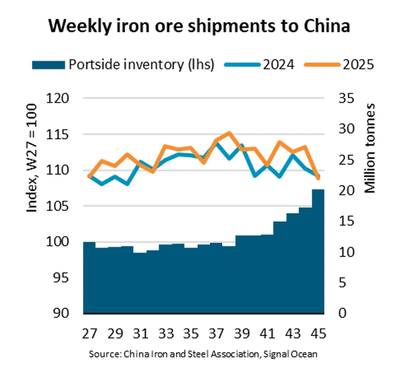

Iron Ore Imports Spike 7% in China

“Iron ore shipments to China have risen 7% y/y since the end of June, following a stable period during the first half of the year. However, Chinese steel production has remained weak, leading to a build-up of portside inventories which reached an eight-month high in week 45,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.

The recent uptick in Chinese purchasing appears to be driven by expectations of increased public spending and a rebound in manufacturing activity, as indicated by China’s Caixin PMI. These factors also contributed to a recovery in iron ore prices which were weak between April and July.

Nonetheless, Chinese steel production fell 3% y/y during the third quarter of 2025 and might have remained weak entering into the fourth quarter, defying market expectations. China’s property crisis continues to weigh on domestic steel demand, as construction activity has yet to recover from already low levels.

“The increase in iron ore shipments has been positively impacting capesize freight rates, driving a 5% y/y increase in the Baltic Capesize Index since the end of June. However, unless China’s steel production picks up, iron ore inventories could rise further and ultimately cause a slowdown in shipments in the near term,” says Gouveia.

China is the world’s largest iron ore importer, and the destination of 74% of the world’s iron ore shipments. Of these, 63% originate from Australia and 22% from Brazil. Most of these shipments are carried by capesize ships, representing 57% of the segment’s tonne mile demand.

Looking ahead, the outlook for Chinese steel demand appears weak, with the World Steel Association forecasting a 1% decrease for 2026. The forecast reflects weakening demand from manufacturing and infrastructure, while the property sector crisis is expected to bottom out.

Growing Chinese steel exports may provide some support for domestic steel production, but we do not anticipate that this will fully compensate for the weaker demand. Export growth is expected to slow due to rising trade barriers on Chinese steel.

“Although the outlook for China’s steel production appears weak, iron ore imports could fare better. Rising global mining capacity is causing an increase in price competition between imports and lower-grade domestic Chinese supplies which could favour more imports. In addition, Guinean iron ore shipments from the Simandou project are expected to reach up to 40m tonnes in 2026 which may lengthen average sailing distances and increase tonne miles,” says Gouveia.