World’s First Retrofit Fund Established

The Global Centre for Maritime Decarbonisation (GCMD), AIM Horizon Investments, and their partners have announced the successful closing of the Fund for Energy Efficiency Technologies (FEET), securing total commitments of up to $35 million, exceeding its initial target.

As the world’s first fund for vessel retrofits leveraging a pay-as-you-save repayment mechanism, FEET directly addresses the long-standing financial barriers hindering the sector’s uptake of vessel retrofits.

The fund has drawn strong interest from across the maritime value chain, including equipment manufacturers, shipowners, and investors.

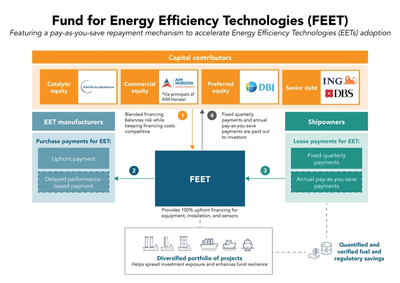

GCMD provides catalytic equity and is FEET’s appointed decarbonisation advisor. FEET is managed by Singapore-based AIM Horizon Investments. Shareholders of AIM Horizon Investments hold the fund’s commercial equity position, while the Development Bank of Japan Inc. (DBJ) holds the preferred equity position. DBS Bank and ING (which acted as Coordinating Bank) have in principle agreed to provide senior debt financing.

Technologies such as wind-assisted propulsion systems and air lubrication systems can deliver immediate fuel savings, assisting shipowners to stay competitive amid tightening regional carbon regulations. However, even with a retrofit market valued at over $20 billion, uncertainties around EET performance and access to financing continue to limit uptake.

A primary difficulty restricting adoption is the inherently variable fuel savings from EET retrofits, which depend on operational and environmental factors, such as routing and weather conditions. The lack of standardised methodologies to accurately measure fuel savings further challenges uptake.

This uncertainty has made the return on investment period difficult to predict and has exacerbated the split-incentive issue, where shipowners are expected to invest in retrofits whereas charterers realise savings.

A pay-as-you-save repayment mechanism addresses payback uncertainty by directly linking repayment to quantified and verified fuel and regulatory savings. Deploying this mechanism requires robust data collection and analysis to isolate the retrofit’s contribution to overall fuel savings.

To this end, GCMD has undertaken performance pilots, equipping vessels with additional sensors to acquire high-precision, high-resolution data and applying rigorous data analytics to quantify fuel savings with statistical confidence. As more data is collected across diverse operating and environmental conditions, these datasets can be used to model and predict savings under varying scenarios.

Commercial vessels are typically financed through loans which have a first priority mortgage over the vessel. As the cost of energy saving devices is small relative to the vessel’s value, it is not practical for shipowners or the existing secured financiers to provide vessel security to prospective retrofit financiers. Consequently, unsecured financing solutions are needed to accelerate the uptake of these technologies.

FEET decouples retrofit financing from vessel mortgages by offering unsecured leases. Under this structure, FEET provides up to 100% financing for the equipment and associated installation and sensor costs, and leases the hardware to shipowners. In return, shipowners make repayments linked directly to verified fuel and regulatory savings. At the end of the lease, ownership of the technology is transferred to the shipowner for a nominal fee.

A blend of catalytic capital, commercial and preferred equities, as well as senior debt, allows FEET to balance financial risk while keeping financing costs competitive. By investing in a diverse portfolio of projects across technologies, manufacturers, vessel owners and types, FEET spreads investment exposure across its portfolio and enhances fund resilience.

Several projects have already been identified and have progressed to the final investment decision stage, reflecting strong industry interest and confidence. The fund remains open to shipowners and ship operators seeking support.

GCMD and AIM Horizon Investments are targeting to scale the fund to $500 million by 2030, capable of supporting around 200 ships.

Scaling FEET will create a virtuous cycle: as the fund grows in size and its projects diversify, financing costs will decrease, and richer performance data on energy efficiency technologies will be generated. This, in turn, will spur further innovation and deliver greater benefits for shipping companies, investors and equipment manufacturers.